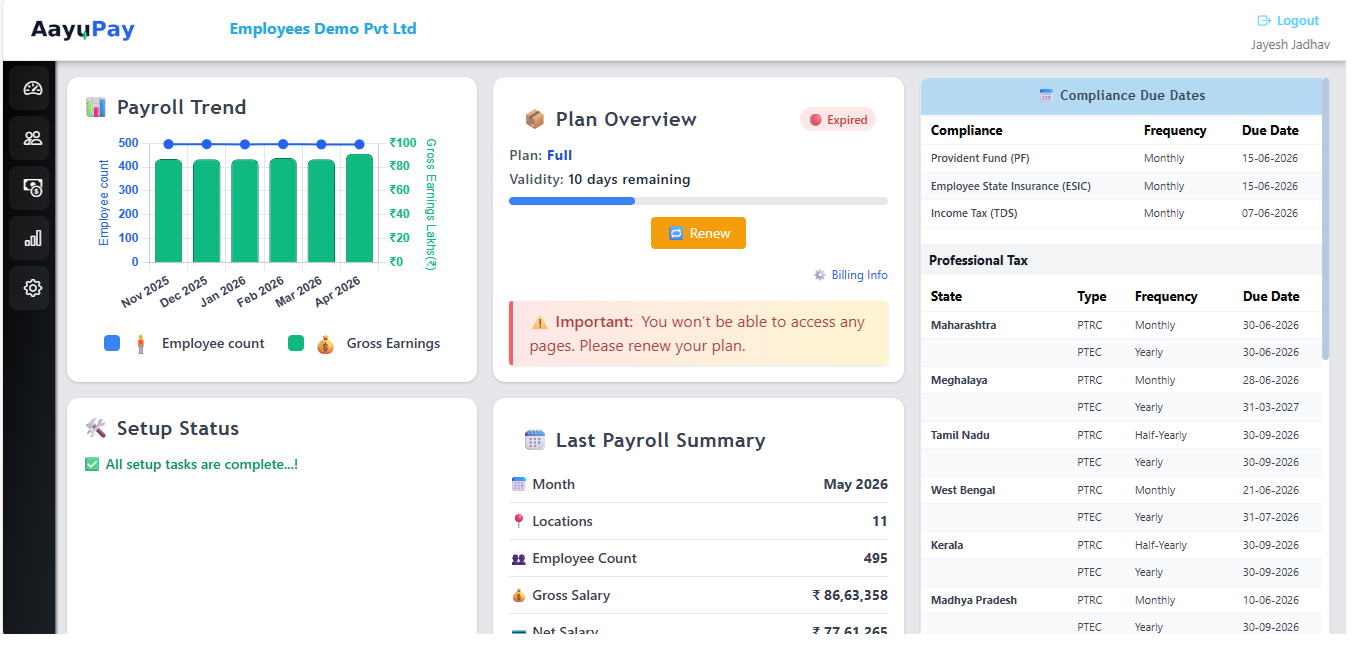

Payroll that lives with you. Smart, Simple, and always Compliant

AayuPay (Aayu = Life) means lifetime peace of mind. No worries about PF, ESIC, LWF, PT & Income Tax rules – We stay up to date so you don’t have to.

Simple & Accurate

At AayuPay, we believe Payroll should be simple, accurate and worry-free. Build with decades of expertise, our platform ensure effortless payroll processing , seamless compliance, and faster results – All tailored for Indian businesses.

Responsive Design

Responsive design adapts to screens of all sizes for optimal viewing.

Decades of Expertise

Backed by 20+ years of hands-on-payroll and compliance.

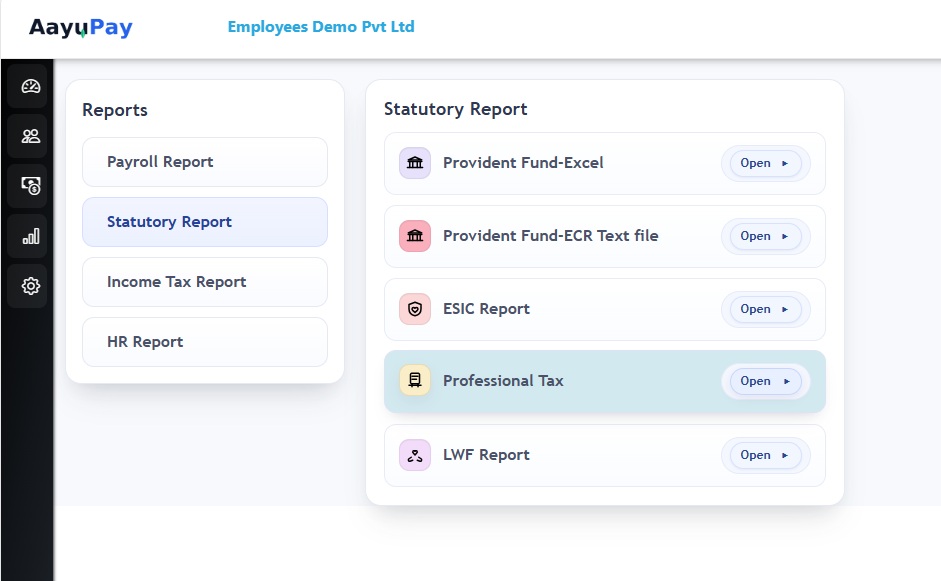

Hassle free Compliance

Stay 100% compliance across all India State PF, ESIC, PT, LWF and Tax.

Speed & Simplicity

Experience payroll that's fast, intuitive and self driven (DIY)

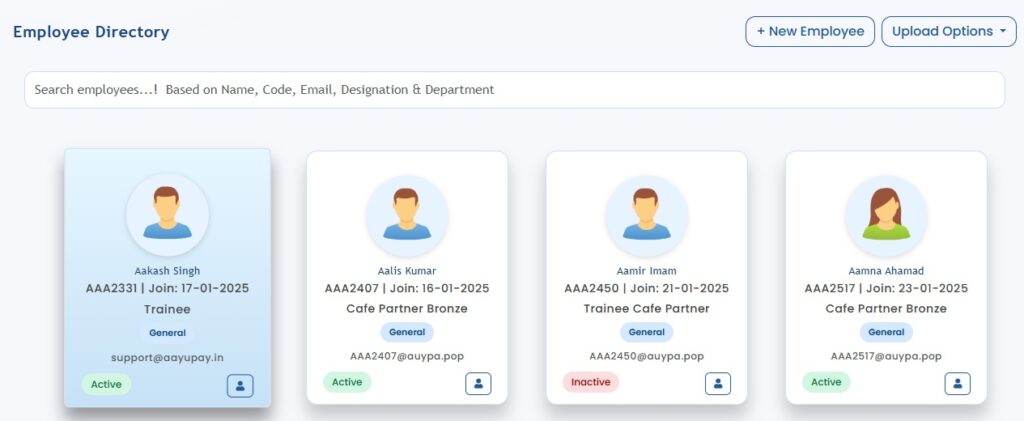

AayuPay – Payroll designed for your needs

Payroll software is designed for maximum usability and efficiency, making it an ideal fit for your organization

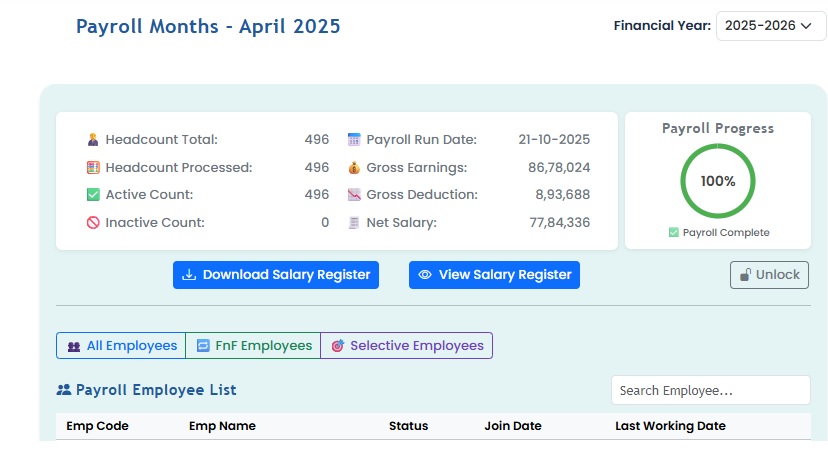

Run Payroll

Instantly,

with smooth

Payroll Report

Instant

available

Frequently asked questions

Once I log in, will I get a demo on how to use the module?

No demo is provided. The system is designed for self-service (DIY – Do it Yourself).

If I have any doubts, how can I reach AayuPay support?

You can reach us via email at support@aayupay.in. You will receive a reply within 2 working days.

Will I get a refund if I decide not to use the product?

Once the payment is made and a plan is chosen, there is no refund option available.

What services does AayPay actually provide?

If you are an HR professional, payroll person, or owner of an establishment with a startup, the main pain point is to process payroll with various statutory and tax deduction which is complicated in Indian Payroll. With AayuPay this is made easy for user to run payroll month on month.

Can I customize the salary breakup in AayuPay?

Yes, AayuPay allows you to customize the existing salary breakup as per your organization’s requirements, ensuring flexibility and compliance with regulations. Also you have ability to add multiple CTC Template as per your organization grade structure.

Is PF, ESIC, LWF, PT and Tax deducted correctly?

Yes, AayuPay compliance deduction is done based on latest amendement under various Acts. For Professional Tax and LWF the Pan India deduction is correctly applicable. The Income Tax computation is calculated as per latest Budget amendement, with latest tax rates.

Is my data secure with AayuPay?

Absolutely. AayuPay uses industry-standard encryption and security measures to ensure that your data is protected at all times. AayuPay is not capturing or asking any information related to employees like PAN and Aadhar. But if your wish to keep track on this then it up to your choice to add.

Does AayuPay offer integration with other HR software?

Sorry, the integration is not possible with any other HR software.

Turn imagination into reality

Unlock AayuPay payroll features and take your organization to the next level.